According to AIA.org, “the Architecture Billings Index (ABI) is a diffusion index derived from the monthly Work-on-the-Boards survey, conducted by the AIA Economics & Market Research Group. The ABI serves as a leading economic indicator that leads nonresidential construction activity by approximately 9-12 months. The indexes are developed from the monthly Work-on-the-Boards survey panel where participants are asked whether their billings increased, decreased, or stayed the same in the month that just ended. According to the proportion of respondents choosing each option, a score is generated, which represents an index value for each month.” To understand the index a little better, an ABI of 50 translates to no change in architecture firm billings from the previous period (month). A score above 50 indicates an increase in billings and a score below 50 indicates a decline in billings.

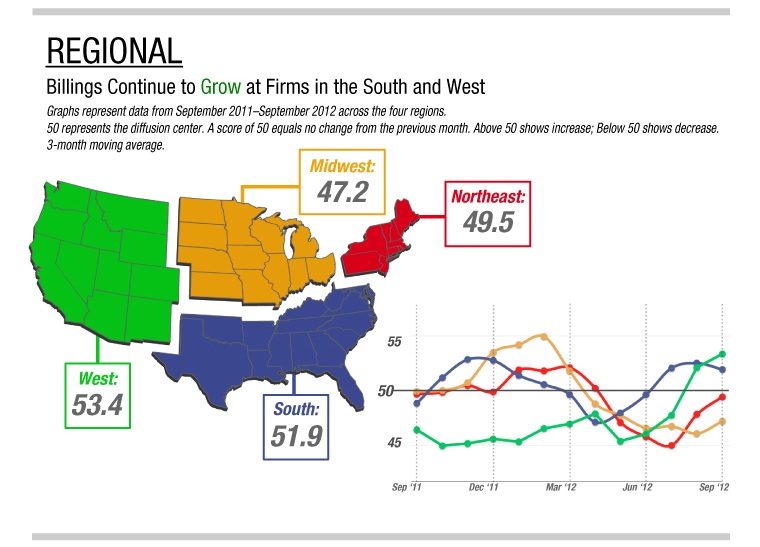

AIA reports that the index has climbed for the second consecutive month in September, up to 51.6. This was a 1.4 increase from August and marks the strongest growth the industry has seen in approximately two years. When analyzing on a regional basis, the West region of the United States lead the pack at 53.4, followed by the South at 51.9. The Northeast (49.5) and Midwest (47.2) showed a decline from last month. Furthermore, when analyzing based on sector, Residential (Multifamily) surged at 57.3, followed by Institutional (51.0) and Commercial/Industrial (48.1).

So, what do these numbers say? Well, it is clear that Multifamily billings in the West are ramping up and are currently some of the strongest in the country. AIA predicts that hard construction spending tied to these numbers will start to occur in 9-12 months, which is your average project entitlement period. The ABI is a unique form of measurement as it allows us to gauge what is on the “horizon” for future construction projects that are currently in the entitlement/predevelopment process.

“Going back to the third quarter of 2011, the multifamily residential sector has been the best performing segment of the construction field,” said AIA Chief Economist Kermit Baker. “With high foreclosure levels in recent years, more stringent mortgage approvals, and fewer people in the market to buy homes, there has been a surge in demand for rental housing.”

To read more, see the AIA story here: http://www.aia.org/practicing/AIAB096284

Images courtesy of AIA.org